bet365最新网址创立于2021年,公司创立之处便专注于装配式建筑、新型节能建材、新型建材工业化解决方案,配备无机复合聚苯不燃保温板全自动生成线、现浇混凝土免拆模板保温板自...

拥有完备的生产制造设备 大型流水线产能优越

bet365备用网址建材拥有一套完善的智能化生产流水线,日产能力40万方,可及时为在建项目输出优质产品。

深根建筑新型材料10余年,可为不同建筑项目提供配套的保温建材产品。

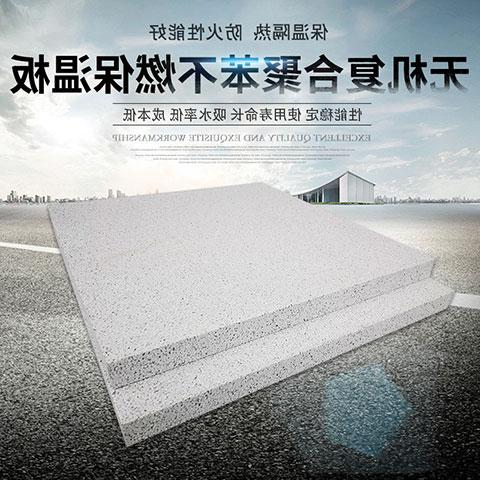

bet365备用网址建材拥有多项产品生产专利,产品具备高保温、A级防火性能、绿色环保使用寿命长,终生只需一次施工。

bet365备用网址建材各项保温材料均通过国家权威机构检测,拥有完善的检测证书。

针对不同建筑项目,bet365备用网址拥有一支经验丰富的技术团队,可根据不同建筑项目定制符合施工需求的保温材料,高效、快捷。

bet365备用网址建材拥有300人的生产型企业,先进的智能化生产设备,确保产品及时投产。

无刺激性和有害气体释放,无矿物类漂浮物对人体皮肤和呼吸道造成的伤害;

建筑物终生只需一次无机复合聚苯不燃保温板保温施工;

无机复合聚苯不燃保温板耐火温度可达1000℃以上,燃烧性能为A2级,属不燃材料,防火安全性能优越。

NEWS CENTER